The Best Online Investment Apps to Make Your Money Work for You

In today’s fast-paced digital world, managing your finances has never been easier. With the rise of online investment apps, both novice and seasoned investors have access to tools that can help them grow their wealth, diversify their portfolios, and achieve financial independence. This article explores some of the best online investment apps, highlighting their features, advantages, and how they can help you make your money work for you.

1. Why Use Online Investment Apps?

1.1 Convenience and Accessibility

Online investment apps allow users to manage their investments from anywhere, at any time. Whether you’re commuting, at work, or relaxing at home, you can monitor your portfolio and execute trades with just a few taps.

1.2 Low Barriers to Entry

Many apps have eliminated traditional barriers such as high minimum investment amounts and hefty fees. This democratization of investing enables individuals from all financial backgrounds to participate in the market.

1.3 Educational Resources

These platforms often provide educational tools, market insights, and tutorials, making them ideal for beginners who want to learn about investing while growing their portfolios.

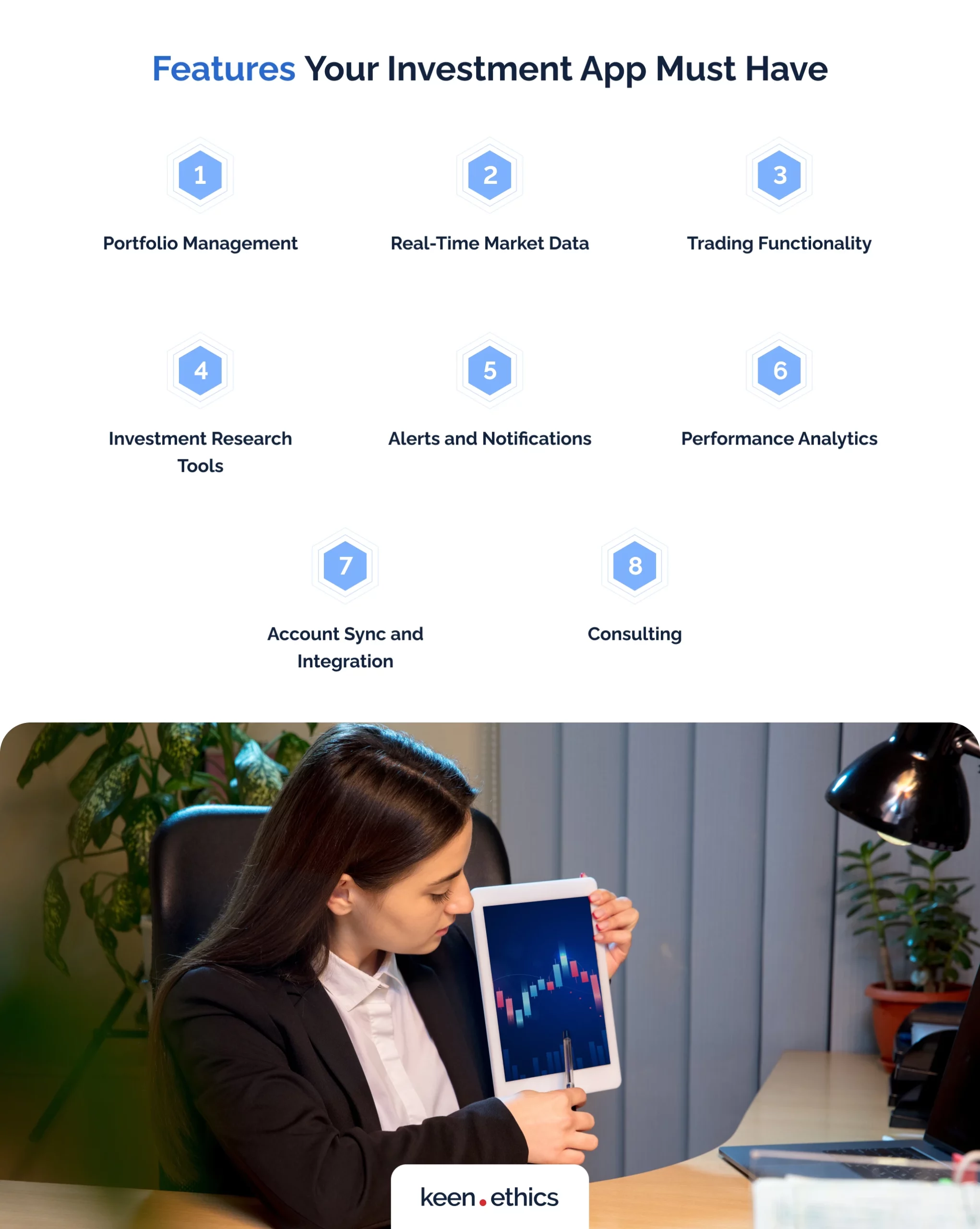

2. Key Features to Look for in Investment Apps

Before diving into specific apps, it’s essential to understand the key features that make an investment app stand out:

- User-Friendly Interface: Easy navigation and intuitive design.

- Low Fees: Minimal or no trading commissions, low account fees.

- Diverse Investment Options: Access to stocks, ETFs, mutual funds, cryptocurrencies, and more.

- Automated Features: Options like robo-advisors or auto-investment plans.

- Educational Tools: Access to learning materials for users to enhance their financial literacy.

- Security: Strong encryption, two-factor authentication, and regulatory compliance.

3. Top Online Investment Apps

3.1 Robinhood

Best For: Commission-Free Trading

Robinhood revolutionized investing by introducing commission-free trades. Its sleek, user-friendly interface is perfect for beginners who want to trade stocks, ETFs, options, and cryptocurrencies.

Key Features:

- No trading fees.

- Access to fractional shares, allowing you to invest in expensive stocks with as little as $1.

- A simplified interface that makes investing straightforward.

- Instant deposits for quick trading.

Drawbacks:

- Limited research and analysis tools.

- Customer service can be slow.

Who Should Use It: Beginners and casual investors looking for a straightforward platform without fees.

3.2 Acorns

Best For: Hands-Off Investors

Acorns is designed for those who want to invest passively. It rounds up your everyday purchases to the nearest dollar and invests the spare change in a diversified portfolio.

Key Features:

- Automatic, micro-investing based on spare change.

- Access to professionally managed portfolios.

- Educational content to help beginners understand the basics of investing.

Drawbacks:

- Monthly fees may be significant for small account balances.

- Limited control over individual investment choices.

Who Should Use It: Individuals who prefer a “set-it-and-forget-it” approach to investing.

3.3 Wealthfront

Best For: Robo-Advising and Automated Investing

Wealthfront offers a powerful robo-advisory platform, automating everything from portfolio management to tax-loss harvesting.

Key Features:

- Personalized, low-cost portfolios.

- Automated financial planning tools.

- Tax-efficient investing strategies.

Drawbacks:

- No access to individual stock trading.

- Requires a minimum initial investment of $500.

Who Should Use It: Investors seeking a sophisticated, automated approach to growing their wealth.

3.4 Fidelity Investments

Best For: Comprehensive Investment Options

Fidelity stands out for its broad range of investment products and robust research tools. It offers everything from individual stocks to retirement accounts and has no commission fees for U.S. stocks and ETFs.

Key Features:

- Extensive research tools and educational resources.

- No account minimums or trading fees on U.S. stocks and ETFs.

- Retirement planning and wealth management services.

Drawbacks:

- The mobile app, while functional, may be overwhelming for beginners due to its vast array of features.

Who Should Use It: Both beginners and experienced investors looking for a comprehensive investment solution.

3.5 E*TRADE

Best For: Active Traders

E*TRADE provides a robust platform for active traders, offering a wide range of investment options and advanced trading tools.

Key Features:

- Access to stocks, options, mutual funds, and ETFs.

- Powerful trading tools, including customizable dashboards and real-time data.

- No commissions on online stock and ETF trades.

Drawbacks:

- The platform can be complex for those new to investing.

Who Should Use It: Experienced investors and active traders looking for advanced tools and flexibility.

3.6 Betterment

Best For: Goal-Based Investing

Betterment is a popular robo-advisor that simplifies investing by aligning portfolios with your financial goals, such as retirement or saving for a major purchase.

Key Features:

- Automated portfolio management.

- Tax-loss harvesting to minimize tax liabilities.

- Goal-setting and tracking tools.

Drawbacks:

- Limited customization for more hands-on investors.

Who Should Use It: Investors who prefer a goal-oriented, hands-off approach.

3.7 SoFi Invest

Best For: Beginner Investors with Diverse Needs

SoFi Invest offers commission-free trading and access to a variety of investment products, including stocks, ETFs, and cryptocurrencies. It also provides financial advice at no extra cost.

Key Features:

- No trading fees.

- Access to financial planners for personalized advice.

- A user-friendly app that combines investing with other financial products like loans and credit monitoring.

Drawbacks:

- Limited research tools compared to competitors.

Who Should Use It: Beginners who want an all-in-one financial solution.

3.8 M1 Finance

Best For: Customizable and Automated Investing

M1 Finance blends the benefits of robo-advisors with the control of self-directed trading. Users can build custom portfolios or choose from pre-designed ones, with automated rebalancing.

Key Features:

- Commission-free trading.

- Flexible portfolio customization.

- Automated rebalancing and dividend reinvestment.

Drawbacks:

- No access to mutual funds or tax-loss harvesting.

Who Should Use It: Investors looking for a balance between automation and control.

4. How to Choose the Right Investment App for You

Choosing the right investment app depends on your financial goals, investment style, and level of expertise.

4.1 Identify Your Investment Goals

Are you saving for retirement, building an emergency fund, or looking for quick gains? Your goals will dictate which app aligns with your needs.

4.2 Evaluate Your Risk Tolerance

Different apps cater to varying risk appetites. If you prefer low-risk investments, look for apps that focus on diversified portfolios. Risk-tolerant investors might opt for platforms offering cryptocurrency or options trading.

4.3 Consider Fees and Costs

While many apps offer commission-free trades, others charge management fees or subscription fees. Be mindful of how these costs affect your overall returns.

4.4 Assess the Tools and Resources

Beginners might prioritize educational content and guided investment options, while advanced investors may need sophisticated trading tools and analytics.

5. The Future of Online Investment Apps

The online investment space continues to innovate, integrating technologies like artificial intelligence, blockchain, and enhanced data analytics. These advancements aim to provide users with more personalized, efficient, and secure investing experiences.

5.1 AI-Driven Insights

Future investment apps may leverage AI to offer hyper-personalized investment strategies, helping users make data-driven decisions.

5.2 Blockchain Integration

Blockchain technology could streamline processes like trade settlements, making transactions faster and more transparent.

5.3 Enhanced Security Measures

With growing concerns over cybersecurity, investment apps are likely to adopt advanced security protocols, ensuring users’ data and assets remain protected.

Conclusion

Online investment apps have transformed the way people manage their finances, making investing more accessible, affordable, and efficient. Whether you’re a beginner taking your first steps or an experienced trader looking for advanced tools, there’s an app tailored to your needs. By leveraging the features and insights provided by these platforms, you can take control of your financial future and make your money work for you.