Bitcoin Unlocked: The Ultimate Guide to Mastering the Digital Gold Revolution

In the past decade, Bitcoin has evolved from an obscure experiment into a global financial phenomenon. Dubbed “digital gold,” it has captured the imaginations of investors, technologists, and even governments around the world. Yet, for many, the concept of Bitcoin remains shrouded in mystery. What is Bitcoin? How does it work? How can you buy, mine, and use it? These are some of the questions we aim to answer in this comprehensive guide.

In this article, we will explore Bitcoin’s origins, how it works, why it’s often referred to as “digital gold,” and how you can get involved—whether you’re looking to buy, mine, or simply learn more about this revolutionary technology.

What is Bitcoin?

Bitcoin is a decentralized digital currency that operates without a central authority or government. It was invented in 2008 by an anonymous person (or group) using the pseudonym Satoshi Nakamoto. Nakamoto introduced Bitcoin as an alternative to traditional fiat currencies, aiming to create a peer-to-peer (P2P) network that would allow for secure, low-cost, and transparent transactions.

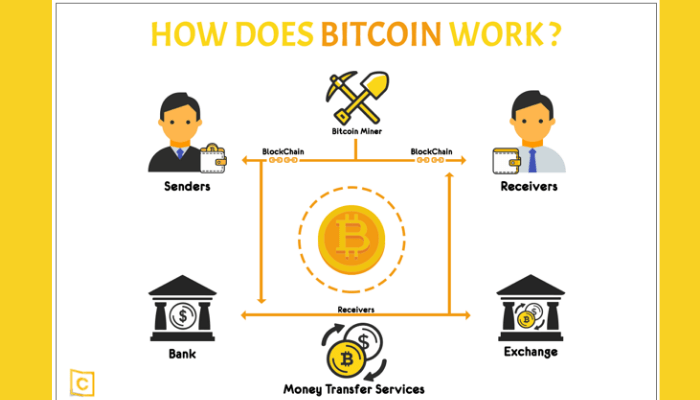

Bitcoin runs on a technology called blockchain, a distributed ledger that records every Bitcoin transaction. Transactions are verified and added to the blockchain by a decentralized network of participants known as “miners.” The currency operates outside of the traditional banking system, making it immune to inflationary policies set by governments or central banks.

Unlike traditional currencies (USD, EUR, GBP), Bitcoin does not exist physically. Instead, it exists as a string of data in a digital form. Bitcoin is stored in digital wallets and can be sent or received over the internet, making it incredibly versatile and accessible.

The Origins of Bitcoin: A Vision of Financial Freedom

Bitcoin’s creation was born out of the financial crisis of 2008. During this time, the world was grappling with the aftermath of the global recession. Governments and banks were seen as the root causes of the crisis, sparking widespread distrust in centralized financial systems.

Satoshi Nakamoto’s vision was to create a currency that did not rely on banks, governments, or intermediaries. Instead, Bitcoin would operate on a decentralized network where individuals could send and receive money directly without the need for a trusted third party. Nakamoto’s motivation was clear: to provide financial autonomy and privacy to individuals, free from the control of central institutions.

The first-ever Bitcoin transaction occurred on January 3, 2009, when Nakamoto mined the genesis block (the first block on the Bitcoin blockchain). This marked the beginning of the Bitcoin era.

How Does Bitcoin Work?

Understanding how Bitcoin works is key to understanding its revolutionary potential. At its core, Bitcoin is a currency that relies on two crucial components: cryptography and the blockchain.

1. Blockchain Technology

The Bitcoin blockchain is a distributed ledger that stores all transactions made using Bitcoin. This ledger is not stored in any single location but is instead maintained by thousands of independent nodes (computers) across the world. These nodes work together to verify and record transactions, ensuring that the entire network is in sync.

Each transaction is grouped into a block. Once a block is complete, it is added to the chain of previous blocks, creating the blockchain. The blockchain is a permanent record of all Bitcoin transactions that have ever occurred, making Bitcoin a transparent and secure system.

2. Decentralization and Consensus

One of Bitcoin’s defining features is its decentralization. Unlike traditional currencies, which are controlled by central banks, Bitcoin operates on a decentralized network. There is no single entity that controls Bitcoin; instead, it is governed by a global network of miners and users.

To ensure that all participants in the network agree on the state of the blockchain, Bitcoin uses a consensus mechanism called Proof of Work (PoW). This mechanism requires miners to solve complex cryptographic puzzles in order to add new blocks to the blockchain. The first miner to solve the puzzle is rewarded with newly minted Bitcoins. This process is called “mining.”

3. Mining Bitcoin

Bitcoin mining is the process by which new bitcoins are created and transactions are added to the blockchain. Miners use powerful computers to solve mathematical problems, and the first miner to solve the problem gets the right to add a new block to the blockchain. As a reward for their work, miners receive newly minted Bitcoin (known as the “block reward”) and the transaction fees associated with the block.

The mining process is highly competitive and requires significant computational power. To mine Bitcoin efficiently, miners use ASIC (Application-Specific Integrated Circuit) devices, which are custom-built for Bitcoin mining. These machines are designed to solve the cryptographic puzzles required to mine Bitcoin much faster than regular computers.

Why is Bitcoin Referred to as ‘Digital Gold’?

Bitcoin is often called “digital gold” due to its many similarities with gold, particularly in terms of scarcity, store of value, and resistance to inflation.

1. Scarcity

One of Bitcoin’s most attractive features is its fixed supply. There will only ever be 21 million Bitcoins in existence. This scarcity is built into the protocol and ensures that Bitcoin cannot be artificially inflated by creating more coins. As of 2024, about 19 million Bitcoins have already been mined, leaving only 2 million left to be mined.

Gold is similarly scarce, which has historically made it a store of value. People value gold because it’s finite and cannot be easily reproduced. Bitcoin shares this trait, making it an attractive option for those looking to hedge against inflation or store value over the long term.

2. Store of Value

Bitcoin, like gold, is often seen as a store of value. In times of economic uncertainty or hyperinflation, people tend to move their wealth into assets that are more stable, like gold or Bitcoin. Unlike fiat currencies, which can be printed endlessly by central banks, Bitcoin’s fixed supply makes it a hedge against inflation.

While Bitcoin’s price can be volatile in the short term, many believe it will appreciate in the long term as demand grows and the supply remains capped.

How to Buy Bitcoin

Now that you understand what Bitcoin is and how it works, you may be wondering how to get your hands on some. There are several ways to buy Bitcoin, each with its own benefits and drawbacks.

1. Cryptocurrency Exchanges

The most common way to buy Bitcoin is through a cryptocurrency exchange. These platforms allow you to purchase Bitcoin using traditional currencies like USD, EUR, or GBP. Some popular exchanges include:

- Coinbase: A beginner-friendly exchange that allows you to buy Bitcoin using bank transfers, credit cards, or debit cards.

- Binance: One of the largest exchanges in the world, offering a wide variety of cryptocurrencies and trading pairs.

- Kraken: Known for its security features and robust set of trading tools.

To buy Bitcoin on an exchange:

- Create an account on the exchange.

- Deposit funds using your preferred payment method.

- Buy Bitcoin by placing a market or limit order.

- Transfer your Bitcoin to a personal wallet for added security.

2. Peer-to-Peer (P2P) Platforms

If you prefer to buy Bitcoin directly from another person, you can use P2P platforms like LocalBitcoins or Paxful. These platforms connect buyers and sellers, allowing them to agree on a price and method of payment. You can buy Bitcoin using cash, PayPal, or other payment methods.

3. Bitcoin ATMs

Bitcoin ATMs are machines that allow you to buy Bitcoin with cash. They are becoming more widespread in major cities. To use a Bitcoin ATM, you simply insert cash, provide your Bitcoin wallet address, and the machine will send the purchased Bitcoin to your wallet.

How to Mine Bitcoin

Bitcoin mining is the process of validating transactions and securing the Bitcoin network. It involves solving complex mathematical problems through the use of high-powered computers.

1. Setting Up Mining Hardware

To mine Bitcoin, you need specialized mining hardware called ASIC miners. These devices are designed specifically for Bitcoin mining and are much more efficient than regular computers or graphics cards.

2. Join a Mining Pool

Because mining Bitcoin is highly competitive, most miners join mining pools. Mining pools are groups of miners who combine their computing power to solve blocks more quickly. When the pool successfully mines a block, the reward is distributed among the participants based on the amount of work they contributed.

3. Mining Software

To connect your hardware to the Bitcoin network, you need mining software. Some popular mining software includes CGMiner and BFGMiner.

How to Use Bitcoin

Once you have acquired Bitcoin, there are several ways you can use it.

1. Transactions

You can use Bitcoin to send money to anyone in the world instantly and with minimal fees. Bitcoin is used by businesses worldwide to accept payments, and more merchants are adopting it every day. Some of the major companies that accept Bitcoin include Overstock, Newegg, and Microsoft.

2. Store of Value/Investment

Many people buy Bitcoin as an investment, hoping its value will increase over time. Bitcoin’s fixed supply and resistance to inflation make it an attractive long-term investment.

3. Remittances

Bitcoin is also used for sending remittances across borders. Because Bitcoin transactions are inexpensive and fast, it is an ideal solution for sending money internationally without the high fees charged by banks or money transfer services.

The Future of Bitcoin

Bitcoin’s future is both exciting and uncertain. As more people recognize its value as a store of value and hedge against inflation, demand for Bitcoin may increase, pushing its price higher. However, Bitcoin also faces challenges,